Should You Throw Away Unused Makeup

l Ways You're Throwing Coin Abroad

Tweak your habits to keep more money in your pocket.

Throwing Coin Abroad on Layaway

While layaway might seem like a sensible style to concord onto something you desire to buy, it's not ever a smart way to net savings. That's because layaway locks you into a certain price and — if ultimately financed by a credit card — additional interest charges.

Read: 12 Easy, Proven Ways To Get Free Coin

Not Using a High-Involvement Savings Account

Having a high-involvement savings account can aid you lot grow your money and build an emergency fund more quickly than with a traditional bank account — so if yous don't take one, you're leaving complimentary coin on the tabular array.

The boilerplate savings account interest rate is 0.09%, according to the Federal Deposit Insurance Corp., but high-interest savings accounts can offering rates that are much higher — hands reaching over 1.00%, which is quite a difference compared to the average rate.

Check Out: nine Successful Money-Making 'Schemes' (That Are Actually Legal)

Trying To Time the Stock Market place

When stocks are on the rising, it's tempting to think you're smart enough to know when to get in and out to make a killing. But this move is one of the worst mistakes rookie investors make.

Experts say it's nearly impossible to do this correctly every single time. Afterward all, you need to be right twice — when you go out of the market place and when y'all go dorsum in.

Notice Out: 35 Useless Expenses You lot Demand To Slash From Your Budget Now

Ignoring Refurbished Appurtenances

It's piece of cake to dismiss refurbished electronics as rejects or factory failures. The truth is, many items are returned for picayune reasons, similar existence the wrong color. Even then, manufacturers subject field these returned projects to rigorous tests. And the difference in toll between refurbished and new usually starts at ten% and tin be as much as 50%.

Detect Out: 39 Careless Ways Retirees Waste Money

Closing the Box on 'Open up Box' Savings

A smashing way to salvage coin when shopping online marketplaces such as eBay is to run across if a vendor has cheaper, brand-new "open up box" products, which are returned items that have been inspected and put back on shelves past retailers.

Paying Full Price for Gas

Even though gas prices aren't at their highest, yous might not be taking reward of gratis means to bulldoze the beak downwards farther, such as by using rewards credit cards for cash back. Make sure to pay off your residual every month to avoid interest charges or belatedly fees that'll eat up any rewards y'all earned. You can also employ the GasBuddy app to find the lowest gas prices in your area.

Paying Total Price for Annihilation

With bargain sites such as Groupon, it'south a wonder why people shop at stores and pay the manufacturer's suggested retail price on annihilation — information technology'southward probably one of the biggest ways you're wasting money. Take advantage of coupon and deal sites to keep more than coin in your wallet year-round.

Forgetting Your Visitor's Employee Stock Buy Program

Your company's employee stock purchase plan typically works past payroll deduction, with the company converting the money into shares at upwards to a 15% discount off the market price.

"If you immediately liquidate those shares every time they're delivered, it'due south like getting a guaranteed 15% rate of return," said Dave Yeske, managing director at the wealth management firm Yeske Buie.

Paying Checking Business relationship Fees

What'south your bank's policy on checking account fees? Some banks waive monthly fees for new customers during a promotional menses, merely will so charge equally much every bit $10 or $12 per month if you don't meet sure balance requirements.

Be enlightened of these terms and conditions then you tin maintain a rest that won't incur fees. If you can't see requirements, talk to a banker about switching over to a free checking account — or switch to a improve bank.

Brand the Virtually of Them: 18 Reasons Why You Should Be Using Your Credit Cards More

Paying Sales Tax

Sales tax can add together upward over the year, peculiarly in places such as Chicago, where it's a hefty 10.25%. But thankfully, many states offer revenue enhancement-gratuitous shopping weekends, which would be a adept time to make any major purchases. So, keep an eye out for any opportunities to go appurtenances taxation-free.

Not Having a Shopping Accountability Partner

1 large problem with shopping at the mall alone or online is the lack of accountability. Spouses — or friends — can practice each other a favor by being accountability partners and asking questions similar, "What'southward being spent? Is information technology being spent wisely? How's the budget holding up?" The idea here is not to police money, simply to gently steer things back when your friend drifts off class.

Not Shopping Ahead for Next Yr

The worst fourth dimension to buy Halloween paraphernalia is the month earlier, and the worst fourth dimension to buy winter gear is in the winter. And so, why not buy your fall clothes for next year when they're "so last season" and stores are eager to dump them to make room for high-priced items? Buying items one to three seasons behind their price height means you'll become a deal.

Impulse Shopping

It's tempting to spend money on impulse buys when y'all're defenseless up in the passion of sales galore. Simply you wouldn't want to come home from the supermarket with a 20-pound cheese bicycle you lot bought on a whim — right? Make a list of what you demand at the store and stick to it.

Running Upwards Balances on High-Interest Credit Cards

Don't get carried away with frivolous purchases — the last matter your wallet needs is a shopping spree. Credit cards can put you on a hamster wheel where making minimum payments barely nibbles at the balance.

If you exercise take a high credit carte du jour remainder, don't fearfulness — you lot can erase it by prioritizing it and not adding to information technology.

Missing Out On Matching Contributions

An estimated two-thirds of Americans are non contributing to a 401(k), co-ordinate to a 2017 study from Vanguard, meaning they are missing out on employer matching — which is basically leaving free money on the tabular array. Don't be ane of these people — have advantage of this complimentary coin that can fund your retirement.

These Don't Work: 50 Terrible Ways To Try and Save Money

Lacking a Conspicuously Defined Plan

From shopping trips to investment moves, it's futile to sweep the numbers nether the rug and promise for the best. Yous need a plan to get the well-nigh out of your money and avoid costly errors.

Part of your financial planning process should include having an emergency fund, and the best way to build one upwardly is through a loftier-involvement savings account. This way, all the money you lot put in will accrue interest at a high rate, so y'all'll be financially prepared for any curveballs life throws your way.

Spending Too Much While Eating Out

Certain, yous don't know how to make Thai food and don't feel similar cooking dinner. But consider how that attitude drains your wallet over time.

Say you consume out for luncheon five times a week and spend $15 on each meal. That's $3,900 you spend a yr. By eating out for lunch just two times a calendar week instead of 5, you save $2,340.

Not Inflating Your Tires Properly

Keeping your tires properly inflated tin can improve your gas mileage by up to 3%, co-ordinate to FuelEconomy.gov. Imagine that: A little bit of air keeps gas prices from inflating.

Confusing Needs and Wants

Whether yous're looking for discretionary cash or more investment funds, it's too like shooting fish in a barrel in the budgeting process to overlook places where yous blow your dough. But, understand what is a need — food, housing, article of clothing, transportation — and what is a want. Hint: The newest designer handbag and a luxury sports car are not needs.

Giving To Wasteful Charities

Charities shouldn't be painted with a broad brush; some brand much better use of your donations than others. A good first step is to check out a nonprofit at the Charity Navigator website, which breaks down the particulars for thousands of charities.

Gambling

Gambling is an epidemic in this country, and compulsive gambling is a very real disorder affecting an estimated 10 1000000 adults in the U.South., according to the N American Foundation for Gambling Habit Assistance. But the unproblematic fact of the matter is that casinos and gambling parlors aren't built because people win more than than they lose.

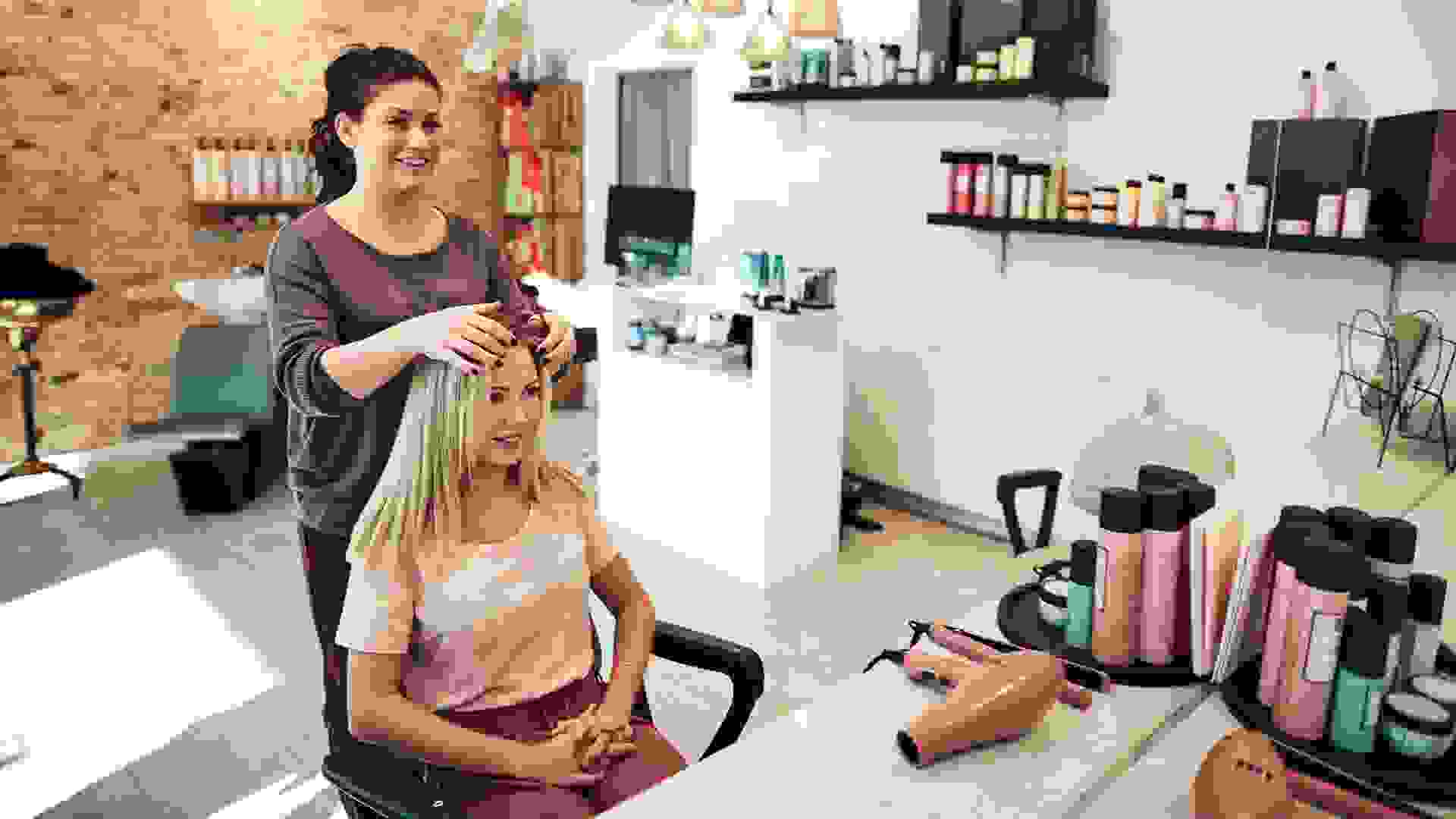

Neglecting New Customer Specials

Whether yous're heading to the new hair salon in town for the first time or getting chiropractic treatment from a wellness heart, don't forget to enquire virtually new client and client specials. Some small-scale-business owners who offer personal care and wellness services desire repeat business and will invite new customers to come in and endeavor their services at a discounted charge per unit.

Stop Now: Thousands of Americans Waste $348 a Year on Subscriptions They're Non Using

Skipping Happy Hour Specials

Y'all might not be extremely hungry come happy hour, but this is the perfect time to enjoy a meal at your favorite restaurant at a discount. You can take advantage of buy one, get i gratuitous deals on many drinks and appetizers, and plough your entire visit into an early dinner.

Not Clipping Grocery Coupons

Whether you need to stock up on snacks or cereal, don't forget to check your newspaper for this calendar week's coupons. If you don't have access to the newspaper, check out the store's circular and other special offers on products you buy every day and then you aren't paying actress on each grocery run.

Skipping Important Warranties

Vehicle warranties can encompass some of the costs of many common machine repairs and stop upward saving you coin in out-of-pocket expenses every fourth dimension you head dorsum to the dealership or garage. Seek out a warranty you lot can afford, but read the fine print — some 3rd-party warranty providers often have many restrictions and limitations.

Along with that, brand sure your smartphone is protected with at to the lowest degree a basic phone warranty. That mode, yous don't rack upwardly a bill of a few hundred dollars merely to replace a croaky screen or a power push button.

Leaving Unused Electronics Plugged In

If yous go out the house in a hurry and forget to unplug the java maker or leave lamps and small appliances turned on all solar day, you're wasting free energy. Lower your free energy pecker by unplugging any appliances you aren't using at any given time. From shaving tools to laptop computers, information technology pays to unplug.

Grocery Shopping When Y'all're Hungry

If your grocery store bills are always high, you might be buying much more than you actually need. Shopping on a full stomach could be all it takes to trim that grocery bill. Then, the side by side time you head to the supermarket, eat a meal or a snack to resist the urge to buy nutrient you lot really don't need.

Ignoring In-Store Savings Apps

Many retailers and drugstores, including Target and Walgreens, have smartphone apps that help you find coupons and discounts on your purchases. Ignoring these apps could keep extra dollars on your bill, so pull out the smartphone as you brand your shopping rounds.

Making Pricey Credit Card Remainder Transfers

If your favorite credit bill of fare issuer is offering you a depression-interest or zero-interest residuum transfer, don't brand the mistake of transferring thousands of dollars over without reading the fine print. Many credit bill of fare companies accuse balance transfer fees as a percentage of the total transfer, so you could end upwards paying a few hundred dollars in transfer charges that negate the benefits of a lower interest charge per unit.

Have the time to calculate the total cost of the balance transfer then you lot don't terminate up making an expensive decision in an effort to consolidate debt.

Tapping Your Retirement Fund for Extra Cash

Dipping into your retirement fund to finance emergencies is one thing — financing a kitchen renovation or taking a prowl with your retirement dough is another. Non merely might yous meet high penalty fees, just you'll also miss out on the chemical compound involvement y'all would accept earned on any money yous take out.

If you want to salve for a habitation improvement projection or vacation, a better style to do this is with a loftier-interest savings account. High-interest savings accounts allow your funds to compound at a high rate, only there's no penalty for making withdrawals whenever you want to.

Overlooking Generics

When y'all're ownership grocery and household staples such as rice, oatmeal and cleaning supplies, being loyal to a item make might exist costing you lot. Unless you're using coupons, you can relieve money on staples just by switching over to a generic brand.

Shop Smarter: 40 Supermarket Buys That Are a Waste product of Money

Stocking Upwards on Bottled Water

You know you lot need to drink 8 glasses a twenty-four hour period, but don't let that goal of staying hydrated burn a pigsty in your wallet. Relieve some money by investing in a h2o filter so you're only paying for replacement filters after your initial purchase.

Paying High Aircraft Fees

Pay attention to shipping charges posted at checkout, or you could be overpaying for items that otherwise qualify for free shipping. Many stores will ship items for gratis when your gild is in a higher place a certain dollar amount, for example. And, some stores offer complimentary shipping yr-round.

Combining orders to meet the minimum and planning ahead can assistance you offset the cost of your next online purchase.

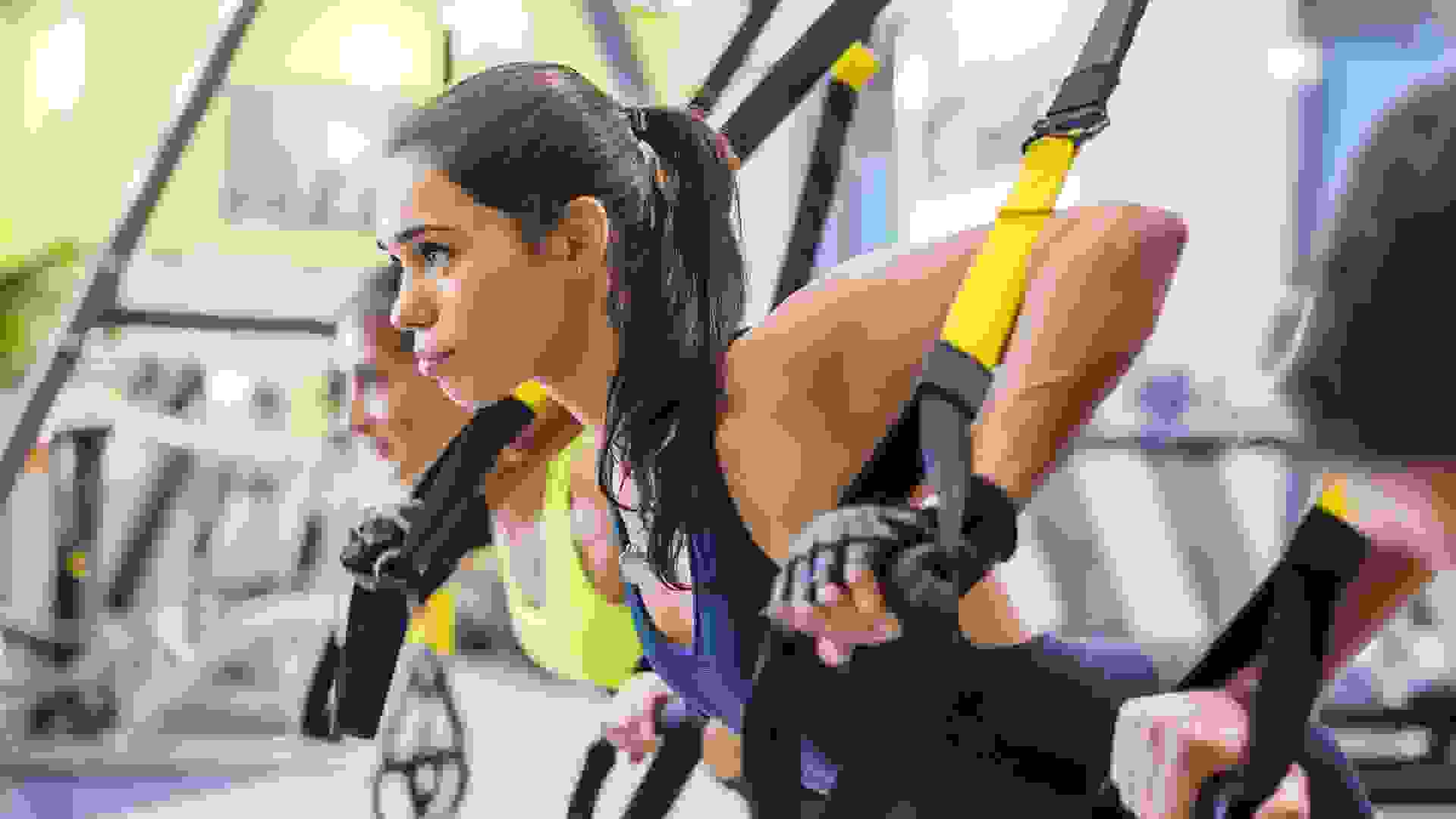

Neglecting Your Gym Membership

Less than one-half of Americans with gym memberships go far to the gym at least twice a week, and six% of those with memberships never actually go, according to a 2019 report past Finder.com. You could exist losing dollars a day just by skipping a few workout sessions a week or neglecting your fettle regimen altogether.

Consider the price of not going to the gym the next time you contemplate skipping a workout. If you're not using your membership, talk to the gym about canceling your membership or putting it on hold.

Missing Post-Holiday Sales

If you're the political party planner of the family, honey to decorate or just enjoy arts and crafts, don't overpay for supplies. From political party hats to Christmas decorations, you lot can find a wide range of party supplies and craft items on auction at party stores and craft stores right after a major holiday. This is the perfect fourth dimension to stock up on holiday-themed items as well as decor and craft supplies yous can use year-circular.

Buying Gift Cards at a Shop or Restaurant

The adjacent time you're thinking about buying a souvenir menu for a friend or family unit member, don't purchase it directly from the store or eating place. Instead, shop warehouse clubs similar Sam'south Lodge or Costco to buy cards at a college value merely for less.

You can notice gift cards for fast-food restaurants, chain restaurants and more with values of $25, $50 or more — but the bodily price yous pay is a few dollars less. Besides, you tin can purchase discounted gift cards through sites such as Gift Card Granny, Raise and Cardpool.

Not Signing Up for Electronic mail Offers

When you lot've found your new go-to online retailer for home furniture, personal care items or makeup, don't pay the full retail price on your kickoff social club. Many online retailers will offering a discount on your first gild if you sign upwards for their email newsletter. And other stores send freebies, exclusive discounts and special offers to email subscribers throughout the twelvemonth.

If you miss out on these offers, yous could be paying actress on your starting time and future orders.

Doing Last-Infinitesimal Grocery Shopping

You already know a trip to the supermarket on an empty stomach is never a good idea, but don't make another common grocery shopping mistake: not waiting for weekly sales to brainstorm. Take the time to map out your grocery strategy and make notation of available deals and coupons and then you're paying the lowest possible price at whatsoever given fourth dimension.

Not Using All Your Warehouse Club Benefits

You make the endeavor to pay your annual membership dues, so accept total advantage of warehouse club member benefits — beyond having access to the store.

From discounts on eyeglasses to travel, yous can save money on a variety of services and products. Review your membership agreement to learn more about perks beyond grocery, clothing and household item discounts available to you.

Read More: 25 Things You Should Never Do With Your Coin

Missing Bill Payments

If you don't open up your post regularly or keep rails of pecker due dates, it's like shooting fish in a barrel to fall into the trap of playing catch-up when you lot realize your bills are overdue.

Most companies will accuse you lot a belatedly fee, and some credit menu companies might abolish your promotional charge per unit if you neglect to pay on time. Do this long enough and the tardily payments could show upwards on your credit report and lower your credit score.

Choosing Valet Parking To Save Fourth dimension

When you're running late and demand to be at an upshot, you might non take the time or patience to find a parking spot about your destination. And then, you take advantage of valet parking to relieve time — but y'all terminate upwards throwing away money in the process.

Unless you lot're prepared to spend $5 to $10 or more plus a tip for each consequence, map out a low-traffic road and go out as early as possible then you don't have to pay extra just to park your car.

Ownership Food at Sporting Events

Y'all've probably already spent a pretty penny on tickets to cheer on your favorite sports squad. So, stay within budget by taking care of food purchases exterior of the stadium.

Many sports venues charge higher prices on snacks and meals because they know attendees accept few options. Swallow a bigger meal on game mean solar day before y'all caput to the field or pack a few snacks for the route so y'all don't take to buy nutrient at the stadium. Read the effect rules beforehand to make certain you can bring your snacks into the venue; otherwise, yous'll have to throw your food — and money — abroad.

Paying Gym Sign-Up or Initiation Fees

You've recommitted to your fitness routine, so buying a new gym membership is probably at the acme of your priority list. But every bit you kickoff searching for your ideal workout destination, don't waste matter money on sign-upwardly fees and other costs that you lot tin easily avoid.

New gyms opening up in your neighborhood might offer free passes and discounts for new members. If and so, take advantage of those deals. You lot might even be able to get fees waived with your AAA membership.

Parking at Hotel Restaurants

Treating your significant other to a gourmet meal or planning a special gathering at a hotel restaurant tin can be a splurge-worthy venture, and y'all'll find enough of parking at the hotel. Withal, guests who aren't staying at the hotel often are charged a daily parking fee as they exit the gate. Ask the restaurant or hotel's front desk to validate your parking and then you aren't paying an extra $20 per visit.

Encounter: fifty Mindless Means You're Called-for Through Your Paycheck

Skipping the Dentist

If you're experiencing any discomfort with your teeth, don't delay your dentist appointment. Schedule an appointment and make room in your budget for dental products your dentist might recommend. Delaying your dental visits could pb to costly dental treatments in the about future.

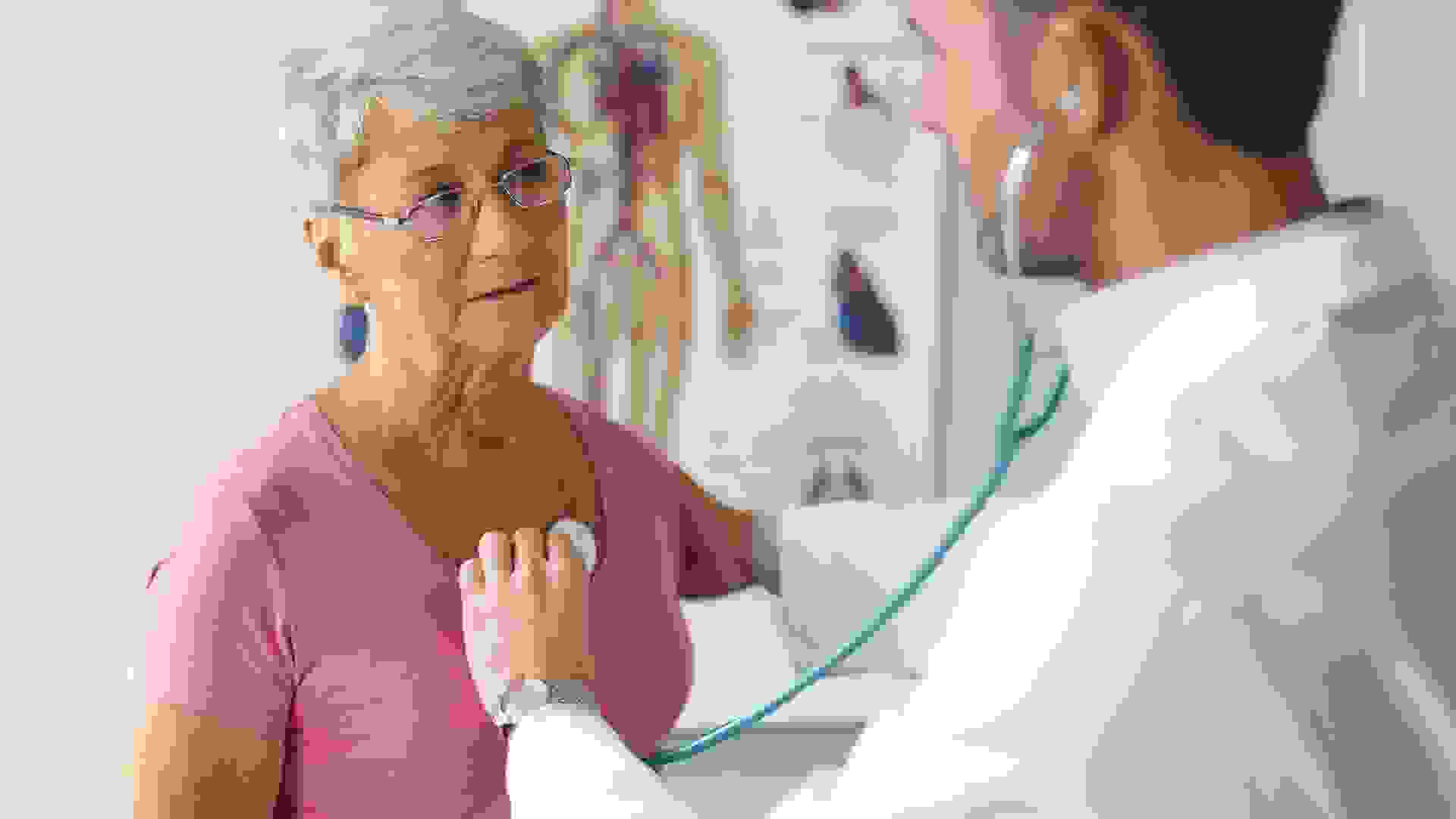

Skipping Your Almanac Md Visit

If you've been skipping your annual doctor visits in an attempt to save on the co-pay or because you don't think you accept any serious medical issues, you might be setting yourself up for costly wellness issues downwards the line. Fill up use of your insurance benefits and budget for additional visits your doc recommends so you lot aren't putting your health at take chances.

Not Shopping Effectually To Fill Your Prescription

When the doctor recommends a prescription drug, don't assume your insurance will encompass everything. Depending on your insurance provider, you could be responsible for a co-pay on all prescriptions or accept to pay a portion of the cost out of pocket. When that's the case, shop around for the best prices at drugstores and pharmacies in the expanse.

Consumer Reports constitute that your next prescription drug could cost as much as 10 times more at one pharmacy over another. Explore options at a warehouse club or even stores such as Target, Walmart or your supermarket to get the all-time deal. If you can, enquire for the generic version of your prescription to save more.

Non Taking Reward of Company Wellness Benefits

If yous piece of work for a corporation or a larger visitor, your employer might offering health and wellness perks in addition to wellness insurance benefits. Many promote these benefits as a way to encourage piece of work-life balance. Don't waste your money on a gym membership, chiropractic adjustments or even counseling services before you see if your employer offers to foot some or all of the bill.

Buying Products at the Salon or Spa

You walk out of the salon or spa with a bag full of fancy products your stylist or massage therapist recommended then you tin recreate the experience at habitation — just y'all probably burned a small-scale hole in your wallet by doing and so.

Instead of giving in to the expensive massage oil or shampoo, have a little patience and relieve your coin. When you become dwelling house, bank check out online megastores such as Amazon to detect authentic brand-proper noun products at a discount. Or, pamper yourself with DIY spa treatments.

Ignoring Rebate Offers

About the Author

Source: https://www.gobankingrates.com/saving-money/savings-advice/ways-youre-throwing-money-away/

Posted by: boedingtorned1980.blogspot.com

0 Response to "Should You Throw Away Unused Makeup"

Post a Comment