Drawing Supply And Demand Zones

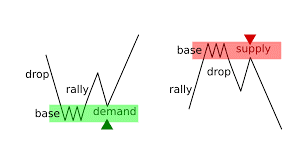

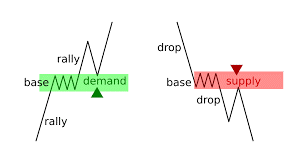

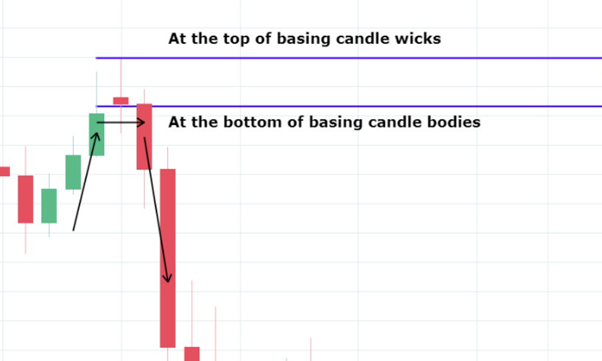

The law of supply and demand governs all market prices. Supply & demand zones put the economic theory into a trading strategy using price charts. Read on to learn more about S&D trading... Supply and demand zones are a popular analysis technique used in day trading. The zones are the periods of sideways price action that come before explosive price moves, and are typically marked out using a rectangle tool in the stocks, forex or CFD trading platform. A supply zone forms before a downtrend Supply and Demand trading strategies use price returning to these zones as entry and exit criteria. The strategy is market-neutral - meaning it can be traded in forex markets, commodity futures, index CFDs etc. You can skip ahead to see how to draw the supply and demand zones for day trading strategies BUT we'd recommend a quick background on the investment theory to give you confidence in why this trading strategy works first… The candlesticks or bars that mark the origin of a strong downtrend are called the supply zone or distribution zone. The candlesticks or bars that mark the origin of a strong uptrend are called the demand zone or accumulation zone. Let's think about the three simplest concepts in trading financial markets Financial markets move in phases of the above. There are uptrends and downtrends or price ranges. Richard Wykoff was one of the first market analysts to explain the interaction of these phases, giving them four labels. They can be seen in Wykoff's classic schematic of market action: It is in the understanding of Wyckoff's explanation of market price action, that supply and demand zones are also known as accumulation and distribution zones. Wykoff explained these phases by the action of the 'whales' which these days are big institutions like money centre banks in forex markets or hedge funds in the stock market. These big players can't just put their whole order into the market at once because they are accumulating so much that it would move the price. So instead, they buy increments within a specified price range. This causes what we see on the chart as a 'demand zone' Equally, when they are selling their position, it can't be all done at once because the selling pressure would send the price sharply lower and reduce their profits because they would be forced to sell into a market decline, caused by their own large orders. So again they sell over a period of time to minimise the market impact of their trades, which creates the 'supply zone'. Eventually the market will break in the way that these whales had been buying or selling, creating a period where supply and demand are out of balance i.e. a price trend. First, it's important to understand that there can be several periods of accumulation during an uptrend and several periods of distribution during downtrends. This means that, just like in classic technical analysis price patterns, there are supply and demand reversal patterns and supply and demand continuation patterns. The Drop-Base-Rally is a bullish reversal pattern The Rally-Base-Drop is a bearish reversal pattern The Rally-Base-Rally is a bullish continuation pattern The Drop-Base-Rally is a bearish continuation pattern This is important because understanding which phase the market is in i.e. what is the underlying trend and how long has it been in place determines which are the best demand and supply zones to look for. In an old trend, you will want to look for reversals. In a new trend you will want to look for continuations. Putting this theory into practise, the idea is to find the place on the chart where demand overcame supply (for long trades) or where supply overcame demand (for short trades). Let's go through the process for correctly identifying supply and demand zones. Let's elaborate on Step 5, which concerns how to draw supply and demand zones. There are two types of candle zones to look for on the chart, either one will proceed a big price move. In trading terms, a base is typically another way of referring to a bottom. But in the context of supply and demand, a base means a small series of candles (typically less than 10) in a tight consolidation. This is simply when one candle is enough to draw the zone. The two candlesticks together often form a classic Japanese candlestick pattern like a hammer or shooting star or bullish and bearish engulfing candlestick patterns. Like in any form of technical analysis or trading strategy, there are strong signals and weak signals. To get the best trading results, we need to ignore the weak signals and take the strong ones. The perfect supply and demand trade setup will see the zone exhibiting all of these features: If the trading range that exceeds the breakout is too wide or has too many long-wick candles, it shows uncertainty and is less likely to represent accumulation from a whale. The demand or supply zone should ideally be between 1 and 10 candles. Accumulation and distribution can take a while but too long and the zone may get exhausted before the re-test later. What we want to see in the breakout candle is an 'Extended range candle' or ERC. This shows a strong price move that has significance. The best zones are when the price has not revisited it since the breakout. Just like support and resistance, the more times supply zones and demand zones are test, the more likely they are to fail. This is when the price temporarily breaks out in the opposite direction but then quickly reverses. This is a sign of big players 'stop hunting' to find extra liquidity for their accumulation or distribution. It's possible to buy supply and demand indicators that have been custom built for the trading platform. However, drawing supply and demand zones tends to be more of an art than a science and some of the best-known modern supply/demand traders and mentors like Sam Seiden draw the zones using the 'rectangle tool' available in most trading platforms, including the FlowBank Pro Trading Platform, which is available on PC, Mac and Mobile devices. Supply and demand zones are typically drawn close to support and resistance levels (S&R levels) but are not quite the same. Support is drawn at the low of a candlestick that has had at least two candlesticks with higher lows on either side. Resistance is drawn at the high of a candlestick that has at least two candlesticks with lower highs on either side. Using supply and demand zones as part of a trading strategy means involving other trading methodologies as well as a sound risk management system. Here we are using the change in trend shown by the moving average to add extra importance to the demand or supply zone as well as to set the direction of the trade Thanks for reading! To test your supply and demand trading skills, click here register for a free demo trading account from FlowBankContents: Supply & Demand Zones

What are supply and demand zones?

A demand zone forms before an uptrend

What are zones in trading?

What is a supply zone?

What is a demand zone?

Wykoff & Market Structure

Types of supply and demand patterns

S&D Reversal Patterns

S&D Continuation patterns

How do you mark a supply and demand zone?

Source: FlowBank Pro Trading Platform

Source: FlowBank Pro Trading Platform STEP 1: Identify current market price

STEP 2: Look left on the chart

STEP 3: Look for big green or big red candles

STEP 4: Find the origin of the big candles

STEP 5: Mark the zone around this 'origin'

How to draw Supply & Demand Zones

Supply/Demand Base

Single Japanese Candlestick

How do you identify a strong supply and demand zone?

Supply and Demand Zone indicators

Supply and demand vs Support and Resistance

Supply and demand trading strategy

Example: The S/D with 20 DMA Strategy

Drawing Supply And Demand Zones

Source: https://www.flowbank.com/en/research/price-action-trading-strategy-supply-demand-zones

Posted by: boedingtorned1980.blogspot.com

0 Response to "Drawing Supply And Demand Zones"

Post a Comment